To protect an invention broadly, a patent application should describe alternative versions of the invention. When developing an invention it may be that several variations of the invention or a component of the invention are considered before a final version is settled on for production.

You often have a better chance of obtaining broad patent protection if those unused variations of the invention are included in the application along with the final version.

The LEGO Patent and Alternatives

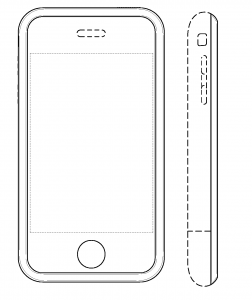

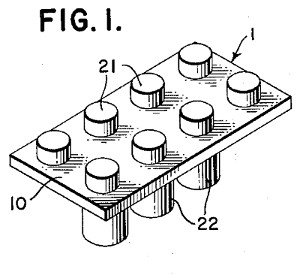

The patent on the LEGO building block toy (U.S. Patent No. 3,005,282) provides a good example. The patent includes not only the iconic block that many recognize, shown at the top of this post. But it also includes six other versions that I have not seen on the market and may not ever have been on the market. Figure 1 shows a version that only has a top plate 10 and no sidewalls 12.

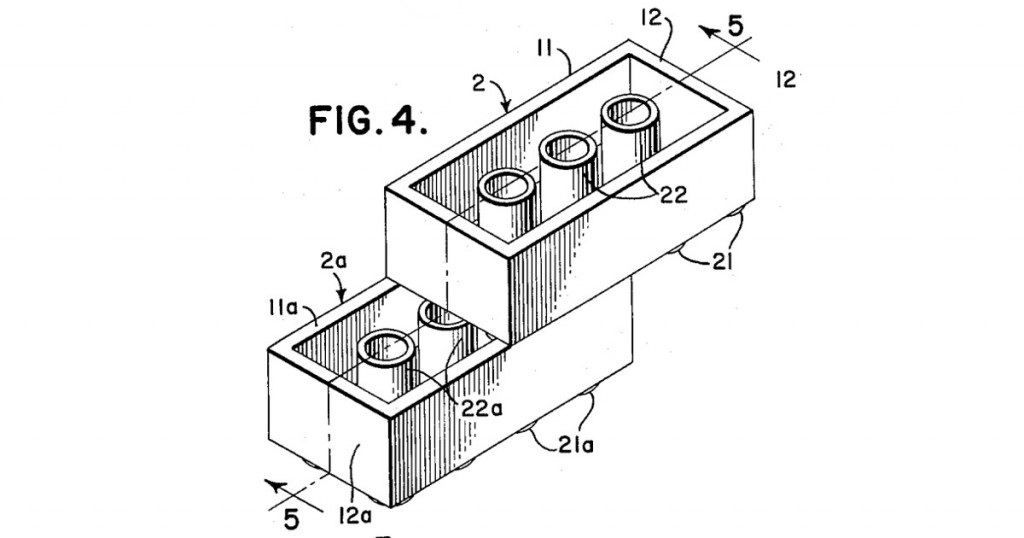

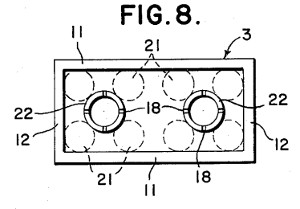

Figure 8 shows an alternative block having two internal projections 22 rather than three shown in figure 4.

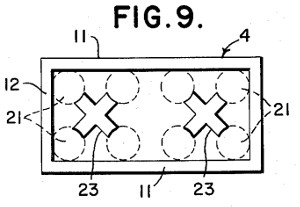

Figure 9 shows an alternative block having X-shapped projections 23 rather than circle shaped projections 22 shown in figure 4.

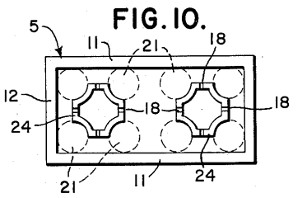

Â Figure 10 shows an alternative block having somewhat star-snapped projections 24.

Figure 10 shows an alternative block having somewhat star-snapped projections 24.

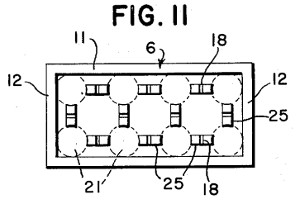

Figure 11 shows an alternative block having multi-component projections 25 that appear similar to the projections 24 of figure 10 but with the corner curved portions removed.

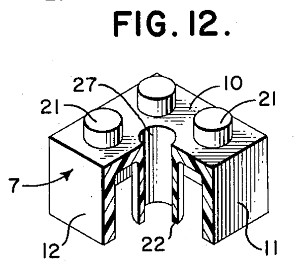

Figure 12 is an alternative block comprising a square shape rather than a rectangle shape and having one projection 22.

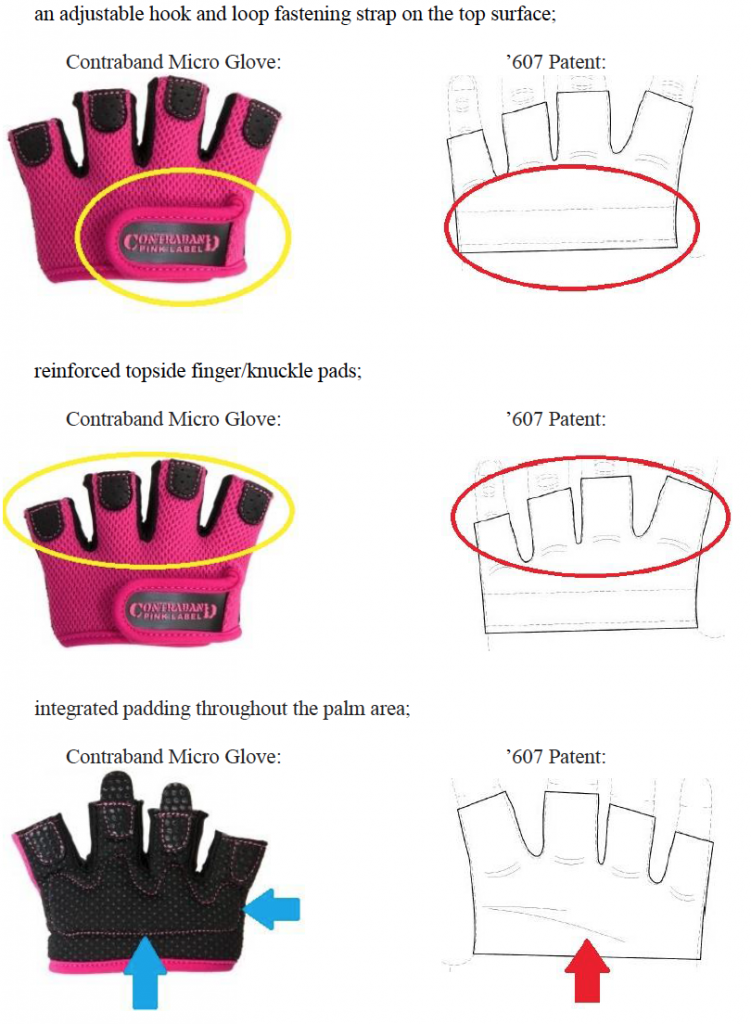

How Disclosure Impacts Patent Scope

Claim 4 of the LEGO patent is directed to a toy building block having “…at least one secondary protuberance extending from said inner face of said bottom wall…” The secondary protuberance is a general reference to the projections that extends below the plate 12, such as projections 22.

However because the patent described many alternative styles of such projections 22, 23, 24, 25, the “secondary protuberance” in the claim would not be limited to cylindrical or circular projections 22 shown in figure 4. Instead, the term “secondary protuberance” should be given a broader meaning to cover different shapes and types of protuberances.

However, it is possible that if the LEGO patent only included cylindrical projections that the claims might be limited to projections of that shape. See my discussion of Tronzo v. Biomet, Inc., 156 F.3d 1154 (Fed. Cir. 1998) for more on this point.

Further, as the patent discloses versions of the block with different numbers of projections, e.g 1, 2, and 3 projections, the patent was able to claim the broader “at least one secondary projection” rather than being limited to “three secondary projections” that are shown in the well known version of the block. In that way, a competitor cannot get around the patent by using 2 or 4 projections to avoid a “three secondary projections” limitation. Instead the use of 2 or 4 projections would be covered by the “at least one secondary projection” limitation of the claim.

Your patent application should probably follow the lead of the LEGO patent in providing alternative versions of your invention. This gives you a better opportunity to get broader protection on your invention and it blocks your competitors from patenting the alternative versions of your invention.

In a 2016Â

In a 2016Â