It is not surprising that the content of a patent application is important. Sometimes the description of something as simple as a washer is important to obtaining a valid patent.

It is not surprising that the content of a patent application is important. Sometimes the description of something as simple as a washer is important to obtaining a valid patent.

If the description of the invention in a patent application is comprehensive and multifaceted, you will have the option of pursuing and possibly obtaining broad and varied claims directed at protecting the invention. However, if the description of the invention is thin or narrow, it could be that you can’t get any valid claims–any protection–on your invention.

This is one of the problems with back-of-the napkin or otherwise thin provisional patent applications. Even when the application has more to it than a back-of-the napkin level of detail, an application can run into problems that result in no patent protection, as was the case in D Three Enterprises, LLC v. Sunmodo Corporation, Nos. 2017-1909, 2017-1910 (Fed. Cir. 2018).

Descriptions of Washers and Brackets

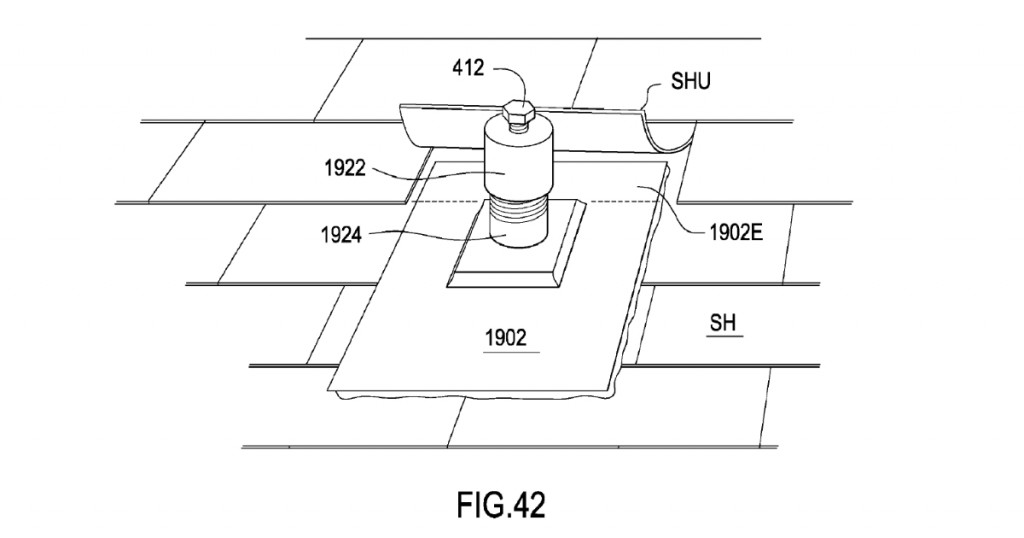

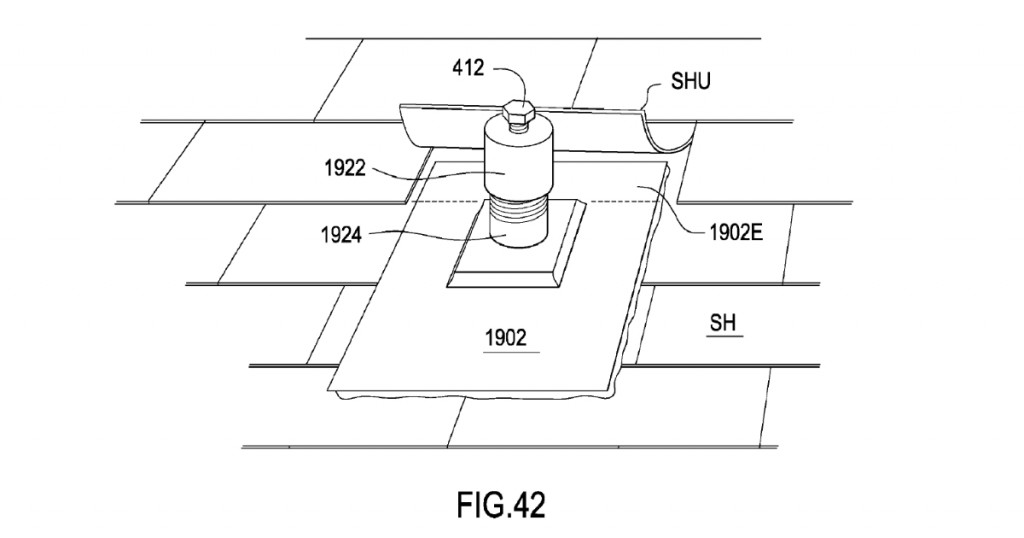

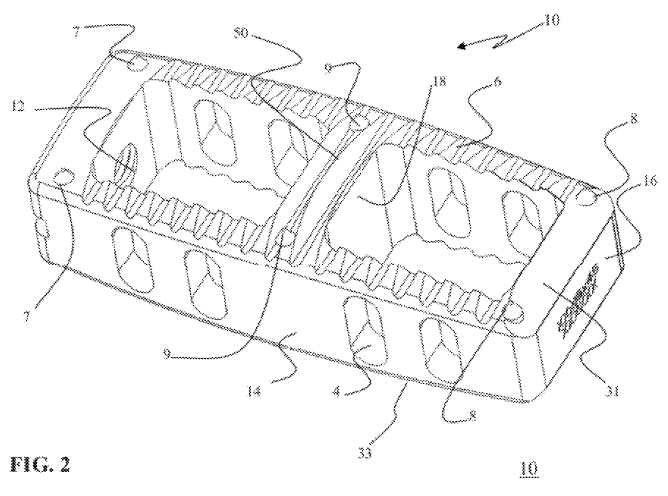

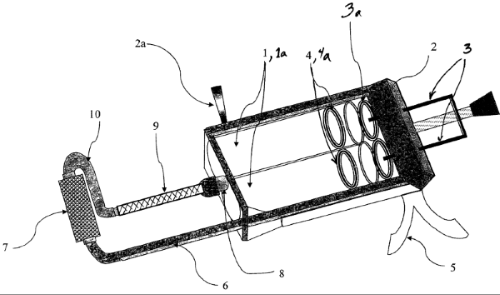

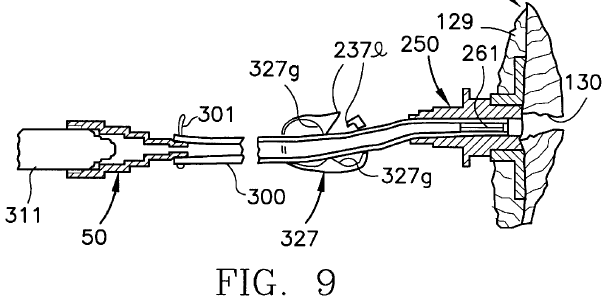

D Three Enterprises sued Rillito for infringing three patents directed to roof mount sealing assemblies that are used to mount items, such as solar panels, to roofs. The patents claimed priority through a chain of patent applications back to a provisional patent application filed in 2009.

Some of the asserted claims of the patents did not require a soft washer. There were various versions of roof mount assemblies shown in the provisional application, but  only one version was washerless. However, the description of the washerless version used a W pronged attachment bracket.

The relevant asserted claims were not limited to a W pronged attachment bracket but recited a more generic bracket. Therefore, because the asserted washerless claims were not limited to the W prong style attachment brackets, those claims were broader than the disclosure in the provisional patent application. As such, the claims did not meet the written description requirement as applied to the provisional application.

As the claims were broader, the court found that they were not entitled to the benefit of the provisional application filing date in 2009. Instead the claims were provided the later filing dates in 2013 and 2014 of the non-provisional applications that resulted in the patents.

But there was intervening prior art that invalidated the asserted claims if the claims did not have the benefit of the 2009 provisional filing date. The court found the asserted claims of the patents were invalid based on the prior art that arose between 2009 and 2013.

Alternative Descriptions

The outcome in this case might be different if the 2009 provisional provided that any of the embodiment shown herein may be provided with or without a washer. Further, the outcome might be different if the provisional stated that a generic bracket could be used with the washerless version of the invention.

Claims in a Provisional Application

D Three’s provisional application (61/150,301) did not include any claims. While the law does not require a provisional application to have claims, one or more claims reciting a washerless version with a generic bracket could have been included in the provisional. Such claims might have provided the written support for the later claims in the resulting patent and changed the result. Just because the USPTO does not require claims in a provisional, doesn’t prevent you from including them.

Application Content Matters

D Three’s provisional application showed a number of different embodiments (variations) of the invention. D Three’s provisional application was not a back-of-the-napkin submission. It had 12 pages of description and 21 pages of drawings. If an application with that much detail can run into problems, so too can applications with less.

It is important that a patent application describe an invention both broadly and in detail regarding the various embodiments (variations) of the invention. This is designed to provide a broad foundation for future patent claims and for a better chance at obtaining broad and valid patent protection.

It is not surprising that the content of a patent application is important. Sometimes the description of something as simple as a washer is important to obtaining a valid patent.

It is not surprising that the content of a patent application is important. Sometimes the description of something as simple as a washer is important to obtaining a valid patent.

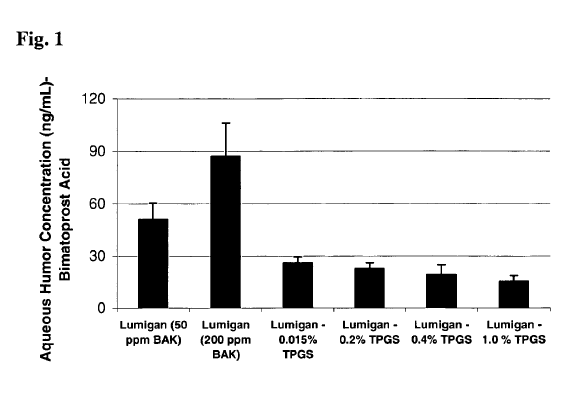

When an invention proceeds contrary to the accepted wisdom in the prior art, this is a strong indication that the invention is not obvious in view of the prior art.

When an invention proceeds contrary to the accepted wisdom in the prior art, this is a strong indication that the invention is not obvious in view of the prior art.

“After experiencing a desire to invent a particular thing, I may go on for

“After experiencing a desire to invent a particular thing, I may go on for