OIP Technologies sued Amazon alleging that Amazon infringed OIP’s patent 7,970,713 directed to a computer based method of automatically determining the optimal price for a product. The court of appeals determined that the claimed method was not patent eligible as an abstract idea under 35 USC 101 in OIP Technologies v. Amazon, No. 2012-1696 (Fed. Cir. 2015).

OIP Technologies sued Amazon alleging that Amazon infringed OIP’s patent 7,970,713 directed to a computer based method of automatically determining the optimal price for a product. The court of appeals determined that the claimed method was not patent eligible as an abstract idea under 35 USC 101 in OIP Technologies v. Amazon, No. 2012-1696 (Fed. Cir. 2015).

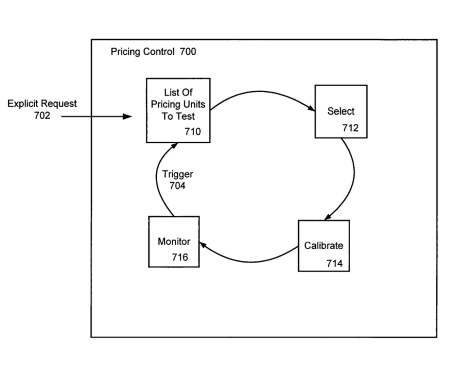

The court summarized the limitations of claims 1 of the ‘713 patent as: “(1) testing a plurality of prices; (2) gathering statistics generated about how customers reacted to the offers testing the prices; (3) using that data to estimate outcomes (i.e. mapping the demand curve over time for a given product); and (4) automatically selecting and offering a new price based on the estimated outcome.”

Following the two step test from Alice v. CLS Bank, 134 S. Ct. 2347 (2014), the court found under step one that the claims were directed to the abstract idea of offer-based price optimization. The court summarized a problem that the method of the ‘713 patent aimed to solve:

The ’713 patent explains that traditionally merchandisers manually determine prices based on their qualitative knowledge of the items, pricing experience, and other business policies. In setting the price of a particular good, the merchandiser estimates the shape of a demand curve for a particular product based on, for example, the good itself, the brand strength, market conditions, seasons, and past sales. . . The ’713 patent states that a problem with this approach is that the merchandiser is slow to react to changing market conditions, resulting in an imperfect pricing model where the merchandiser often is not charging an optimal price that maximizes profit.

Accordingly, the ’713 patent teaches a price optimization method that “help[s] vendors automatically reach better pricing decisions through automatic estimation and measurement of actual demand to select prices.”

The court found that the offer-based price optimization of the ‘713 patent was similar to other ‘fundamental economic concepts” found to by abstract ideas and then cited the following cases: Alice, 134 S. Ct. at 2357 (intermediated settlement); Bilski v. Kappos, 561 U.S. 593, 611 (2010) (risk hedging); Ultramercial, Inc. v. Hulu, LLC, 772 F.3d 709, 715 (Fed. Cir. 2014) (using advertising as an exchange or currency); Content Extraction & Transmission LLC v. Wells Fargo Bank, Nat’l Ass’n, 776 F.3d 1343, 1347 (Fed. Cir. 2014) (data collection); Accenture Global Servs., GmbH v. Guidewire Software, Inc., 728 F.3d 1336, 1346 (Fed. Cir. 2013) (generating tasks in an insurance organization).

In the second step of the Alice test, the court found that the other elements of the claims did not transform the abstract idea of offer-based price optimization into a patentable method. The court found that the additional elements in the claims merely recited well-understood, routine conventional activities either by requiring conventional computer activities or routine data-gathering steps.

The court concluded that “[a]t best, the claims describe the automation of the fundamental economic concept of offer-based price optimization through the use of generic-computer functions.