CLS Bank v. Alice Corp., Dkt. No. 2011-1301 (Fed. Cir. May 10, 2013) (en banc).

Previously I noted that the USPTO told its Patent Examining Corps that the Federal Circuit’s decision in CLS Bank v. Alice, Dkt. No. 2011-1301 (Fed. Cir. May 10, 2013) resulted in “no change in examination procedure for evaluating subject matter eligibility.” In this post I will summarize the various opinions in CLS Bank.

The district court held that certain claims of Alice’s U.S. Patents 5,970,479 (the “’479 patent”), 6,912,510 (the “’510 patent”), 7,149,720 (the “’720 patent”), and 7,725,375 (the “’375 patent”) are invalid under 35 U.S.C. § 101 as being directed to patent in-eligible subject matter.

Result without Agreement on Reasons. On May 10, 2013 the Federal Circuit issued its en banc opinion in CLS Bank v. Alice, Dkt. No. 201. The court’s main per curiam opinion provided, in total:

Upon consideration en banc, a majority of the court affirms the district court’s holding that the asserted method and computer-readable media claims are not directed to eligible subject matter under 35 U.S.C. § 101. An equally divided court affirms the district court’s holding that the asserted system claims are not directed to eligible subject matter under that statute.

The court was sharply divided across six separate concurring and dissenting opinions. A majority of the judges could not agree on the reason for the result. Therefore as noted by Judge Newman, the en banc review was hoped to provide certainty regarding the bounds of patentable subject matter by providing an objective standard, but this failed as a majority of the court could not agree on such a standard. As Newman stated regarding the CLS Bank opinion. “…we have propounded at least three incompatible standards, devoid of consensus, serving simply to add to the unreliability and cost of the system of patents as an inventive for innovation.” Newman Op. at 1-2. Therefore the result of future appeals in the area of software subject matter will depend on the random selection of the panel of judges hearing the particular appeal, unless the case is resolved by the Supreme Court or by a later en banc case at the Federal Circuit.

Summary By Opinion

- Judges Lourie, Prost, Reyna, and Wallach. Judge Lourie would have invalidated Alice’s methods, computer-readable media, and systems claims as claiming patent ineligible subject matter.

- Chief Judge Rader and Moore would invalidate Alice’s methods and computer-readable media claims, but upheld the system claims.

- Judges Linn and O’Malley would have upheld all the claims as patent eligible.

- Judge Newman would have upheld all the claims as patent eligible.

Summary by Claim Type

- Method Claims:

- Valid: Linn, O’Malley, and Newman

- Invalid: Lourie, Dyk, Prost, Reyna, Wallach, Rader, and Moore

- Computer-Readable Media Claims

- Valid: Linn, O’Malley, and Newman

- Invalid: Lourie, Dyk, Prost, Reyna, Wallach, Rader, and Moore

- System Claims

- Valid: Rader, Moore, Linn, O’Malley, and Newman

- Invalid: Lourie, Dyk, Prost, Reyna, and Wallach

J. Lourie: All Claims Not Patent-Eligible

Method claims. Claim 33 of the ‘479 patent was a representative method claim:

A method of exchanging obligations as between parties, each party holding a credit record and a debit record with an exchange institution, the credit records and debit records for exchange of predetermined obligations, the method comprising the steps of:

(a) creating a shadow credit record and a shadow debit record for each stakeholder party to be held independently by a supervisory institution from the exchange institutions;

(b) obtaining from each exchange institution a start-of-day balance for each shadow credit record and shadow debit record;

(c) for every transaction resulting in an exchange obligation, the supervisory institution adjusting each respective party’s shadow credit record or shadow debit record, allowing only these transactions that do not result in the value of the shadow debit record being less than the value of the shadow credit record at any time, each said adjustment taking place in chronological order; and

(d) at the end-of-day, the supervisory institution instructing ones of the exchange institutions to exchange credits or debits to the credit record and debit record of the respective parties in accordance with the adjustments of the said permitted transactions, the credits and debits being irrevocable, time invariant obligations placed on the exchange institutions.

J. Lourie, joined by J. Prost, Reyna, and Wallach, found this claim describes the concept of reducing settlement risk by facilitating a trade through a third party, which is an abstract idea. Then the issue was whether the claim adds “significantly more” to the abstract idea. J. Lourie found that none of the limitations in the claim added anything of substance to the claim beyond the abstract idea.

J. Lourie found that the computer limitation (the parties agreed that claim 33 required a computer) was nothing more than an “insignficant post solution activity.” J. Lourie stated that “At its most basic, a computer is just a calculator capable of performing mental steps faster than a human could.” J. Lourie continued, “Unless the claims require a computer to perform operations that are not merely accelerated calculations, a computer does not itself confer patent ability.”

Computer-Readable Medium Claims. Claim 39 is a representative computer-readable medium claim, partly reproduced below:

39. A computer program product comprising a computer readable storage medium having computer readable program code embodied in the medium for use by a party to exchange an obligation between a first party and a second party, the computer program product comprising:

program code for causing a computer to send a transaction from said first party relating to an exchange obligation arising from a currency exchange transaction between said first party and said second party; and

program code for causing a computer to allow viewing of information relating to processing, by a supervisory institution…

By looking passed “drafting formalities” J. Lourie found that claim 39 was not truly drawn to a specific computer readable medium, rather than the underling method of reducing settlement risk using a third party intermediary. Therefore, J. Lourie would find the medium claims ineligible.

System Claims. Claim 1 of the ‘720 patent is a representative of the contested system claims, partly reproduced below:

1. A data processing system to enable the exchange of an obligation between parties, the system comprising:

a data storage unit having stored therein information about a shadow credit record and shadow debit record for a party, independent from a credit record and debit record maintained by an exchange institution; and

a computer, coupled to said data storage unit, that is configured to (a) receive a transaction; (b) electronically adjust said shadow credit record and/or said shadow debit records…

J. Lourie asserted that the computer-based limitations recited in the system claims cannot support any meaningful distinction from the computer-based limitations that failed to supply an “inventive concept” to the related method claims. J. Lourie asserted that the system claims recited a handful of computer components in generic, functional terms that would encompass any device capable of performing the same ubiquitous calculations, storage, and connectivity functions required by the method claims.

J. Lourie stated that “No question should have arisen concerning the eligibility of claim to basic computer hardware under 101 when such devices were first invented.” The judge further stated, “But we are living and judging now . . . and have before us not the patent eligibility of specific types of computer or computer components, but computers that have routinely been adapted by software consisting of abstract ideas, and claimed as such, to do all sorts of tasks that formerly were performed by humans.” Further the judge stated, “Abstract methods do not become patent-eligible machines by being clothed in computer language.”

Rader Opinion: System Claims Not Abstract

The opinion by C.J. Rader, J. Linn, Moore, O’Malley (the “Rader Opinion”), noted that “any claim can be stripped down, simplified, generalized, or paragraphed to remove all of its concrete limitations, until at its core, something that could be characterized as an abstract is revealed.” “Such an approach would ‘if carried to its extreme, make all inventions unpatentable because all inventions can be reduced to underlying principles of nature which, once known, make their implementations obvious. ” Further, “A court cannot go hunting for abstractions by ignoring the concrete, palpable, tangible limitations of the invention the patentee actually claims.”

The Rader Opinion concluded that “where the claim is tied to a computer in such a way that the computer plays a meaningful role in the performance of the claimed invention, and the claim does not preempt virtually all uses of the underlying abstract idea, the claim is patent eligible.” The Rader Opinion found the system claims patent eligible noting that there were four separate structural components in the system claims: a computer, a first party device, a data storage unit, and a communications controller. The specification provided tat the core of the system hardware is a collection of data processing units” so that the structural and functional limitations were not mere conventional post-solution activities. The Rader Opinion concluded that labeling the claimed system an abstract concept “wrenches all meaning from those words, and turns a narrow exception into one which may swallow the expansive rule.

The Part VI of Rader Opinion joined by only J. Moore, found that the method and medium claims were not patent eligible.

J. Moore: The Death of Technology Patents Under J. Lourie’s View

J. Lourie’s view has broad negative implications for protecting software and technological inventions. As noted in Judge Moore’s opinion, “If all of these claims, including the system claims are not patent-eligible, this case is the death of hundreds of thousands of patents, including all business method, financial system, and software patents as well as many computer implemented and telecommunications patents.” Moore noted that if all the claims at issue in CLS Bank were invalid then “so too are the 320,799 patents which were granted from 1998-2011 in the technology area ‘Electrical Computers, Digital Processing Systems, Information Security, Error/Fault Handling.'” In J. Moore’s view “if the reasoning of Judge Lourie’s opinion were adopted it would decimate the electronics and software industries.” Moore Op. at 2, note 1.

J. Moore noted that in In re Alappat, 33 F. 3d 1526, the court held patent-eligible a claim that would read on a general purpose computer programmed to carry out the operations recited in the claims. On page 8 and 9 of the slip opinion, J. Moore correctly noted that the distinction between hardware and software is not helpful as programs written in software could also be hard-programed in hardware. J. Moore stated software effectively “rewires a computer, making it a special purpose device capable of performing operations it was not previously able to perform.”

J.Moore noted that if the system claims in this case did not clear the 101 hurdle, “then the abstract idea exception will be insurmountable bar for innovators of software financial systems and business methods, as well as for those in the telecommunications field.” J. Moore stated:

“Every software patent makes a computer perform different functions–that is the purpose of software. Each Software program creates a special purpose machine, a machine which did not previously exists (assuming the software is novel). The machine ceases to be a general purpose computer when it is running the software. It does not, however, by virtue of the software it is running, become an abstract idea.”

J.Moore provided that the heavy lifting for considering the inventiveness of such systems claims directed at a computer running specific software is not abstractness under section 101 but rather is the novelty (newness) requirement of section 102 and the non-obviousness requirement of section 103. Section 102 and 103 can handle knocking out patents directed to inventions that merely take a known or abstract idea and put it on a computer.

J. Linn’s Opinion: All Claims Patent Eligible under the District Court’s Construction

J. Linn and O’Malley (the Linn opinion) would have found all the method, medium, and system claims patent eligible. The J. Linn opinion noted that because of the procedural stage of the case, the parties and the trial court agreed that the claims should be construed in Alice’s favor and that the method and medium claims required a computer. Therefore the Linn Opinion would have found all the claims as construed by the district court to be patent eligible.

Further the Linn Opinion acknowledged the concerns expressed by Amici Curiae: Google, Dell, Facebook, Intuit, Rackspace, Red Hat, Zynga and Internet retailers regarding the proliferation and aggressive enforcement of low quality software patents. However, J. Linn noted that Congress could make changes in the law, but broadening what is a narrow exception to the statutory definition of patent eligible should not be the vehicle to address the concerns through the courts.

J. Newman: Section 101 is a Course Filter – All Claims Patent Eligible

J. Newman would have found all claims patent eligible. Newman’s opinion set forth three principles: (1) section 101 is an inclusive statement of patent-eligible subject matter, (2) the form of the claim does not determine section 101 eligibility, and (3) experimental use of patented information is not barred. Newman stated that there is no need for an all purpose definition of “abstractness” or “preemption” as was “heroically” attempted in the various opinions. Newman wants a very broad section 101 interpretation that would let the other provisions of the patent act do the work in determining patentability such as novelty, utility, prior art, obviousness, description enablement.

Conclusions

C.J. Rader, J. Linn, and J. Moore’s views are the best approach to section 101 patent eligible subject matter regarding system claims. When a claim includes computer or electronic elements that are more than mere post solution activities, those are specific tangible items that cannot reasonably be said to be “abstract.” As for J. Lourie’s opinion providing the view to get to the gist of the claim, that is a slippery slope and there is no principled way to distinguish when to ignore tangible components of a claim to get to the gist of the underlying claim and when those tangible components should not be ignored. Every claim term should be considered.

Further, J. Linn is correct that the concerns regarding low quality patents are not best remedied a broad judicially created “abstractness” exception that interprets system claims with integral tangible components as abstract. The issues regarding technology patents should be handled by Congress or through other patent requirements regarding novelty (102) and non-obviousness (103). As noted in several opinions, every claim can be reduced to an abstract concept by stripping away the details and components. However, if such an approach is taken, the exception could expand to swallow the patentability of all inventions.

Practice Tip

In view of this decision, patent applications directed to software or were the invention utilizes software should include at least one set of system claims because, of all the claim types of Alice patents, the system claims garnered the most support from judges regarding patent eligibility.

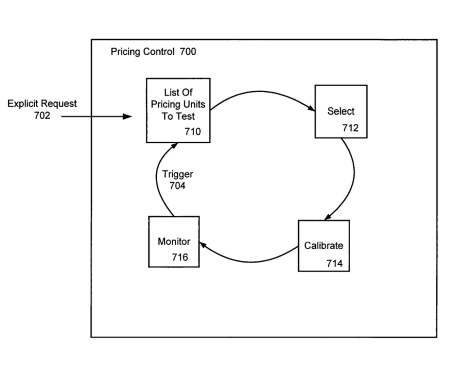

OIP Technologies sued Amazon alleging that Amazon infringed OIP’s patent 7,970,713 directed to a computer based method of automatically determining the optimal price for a product. The court of appeals determined that the claimed method was not patent eligible as an abstract idea under 35 USC 101 in OIP Technologies v. Amazon, No. 2012-1696 (Fed. Cir. 2015).

OIP Technologies sued Amazon alleging that Amazon infringed OIP’s patent 7,970,713 directed to a computer based method of automatically determining the optimal price for a product. The court of appeals determined that the claimed method was not patent eligible as an abstract idea under 35 USC 101 in OIP Technologies v. Amazon, No. 2012-1696 (Fed. Cir. 2015). Today test results from a pregnant mother’s blood can detect characteristics of the fetus, such as genetic defects or gender. The method of detecting such characteristics was found non patent eligible by the Court of Appeals in

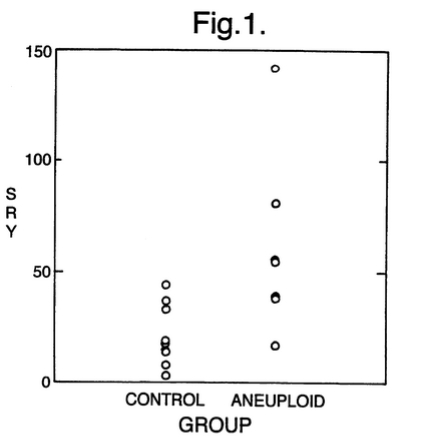

Today test results from a pregnant mother’s blood can detect characteristics of the fetus, such as genetic defects or gender. The method of detecting such characteristics was found non patent eligible by the Court of Appeals in